What Your Home Is Really Worth and Why It Matters

If you own a home in Calgary, chances are you have asked one of these questions recently:

Why did my city assessment change this year?

Is my assessed value the same as what my home would sell for?

Does a higher assessment mean higher taxes?

Should I appeal my Calgary property assessment?

What is my Calgary home actually worth right now?

These are smart questions, and they matter more than ever in today’s market.

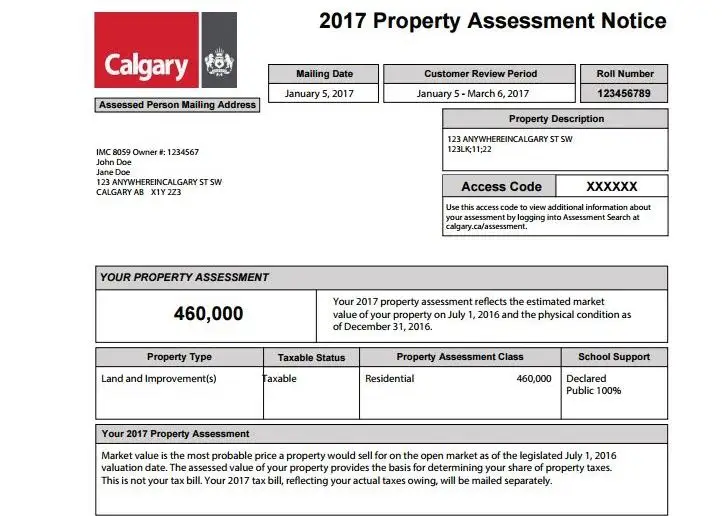

Each year, the City of Calgary sends property owners an assessment notice that estimates the value of their home. Many homeowners assume this number reflects what they could sell for. In reality, city assessed value and market value are two very different things.

Understanding the difference can help you make better decisions around selling, refinancing, appealing your assessment, or planning your next move.

This guide explains how Calgary property assessments work, how they differ from real market value, and how to determine what your home is truly worth today.

What Is a City Assessed Value in Calgary?

A city assessed value is the City of Calgary’s estimate of your property’s market value, calculated for taxation purposes only.

Key points to understand:

The assessment reflects market conditions as of July 1 of the previous year

It is based on mass appraisal models, not individual home inspections

It uses sales data from similar properties across the city

It is designed to ensure fair distribution of property taxes, not pricing accuracy

This means your 2026 assessment is looking backward, not at what is happening in the market today.

The assessment system works well at a citywide level, but it has limitations when applied to individual homes.

Why Calgary Property Assessments Have Increased in Recent Years

Many Calgary homeowners have seen noticeable increases in assessed values over the past few assessment cycles.

This is largely due to:

Strong population growth in Calgary and surrounding communities

Increased demand relative to supply in key neighbourhoods

Rising construction and replacement costs

Significant price movement in certain property types, especially condos and townhomes

These increases often spark concern, particularly around taxes, but it is important to separate assessment value from tax impact and from true market value.

Assessed Value Does Not Equal Property Taxes

One of the most common misconceptions in Calgary real estate is that a higher assessed value automatically means much higher property taxes.

In reality:

Property tax rates are set after assessments are finalized

If most properties increase in value, the tax rate is adjusted accordingly

Your taxes are based on your share of the overall tax base, not just your individual increase

This is why two homeowners with similar assessment increases may see very different tax outcomes.

What Is Market Value in Calgary Real Estate?

Market value is the price a knowledgeable, willing buyer would pay for your home in current market conditions, with no pressure on either side.

Unlike city assessments, market value is influenced by:

Current supply and demand

Buyer behaviour and competition

Interest rates and affordability

Neighbourhood momentum

Condition, upgrades, and layout

Timing and seasonality

Market value is dynamic. It can change month to month, sometimes week to week, depending on what is happening locally.

Why Assessed Value and Market Value Often Differ

It is very common for a Calgary home’s assessed value to be higher or lower than its actual selling potential.

Here are the main reasons why.

1. Timing Lag

City assessments are based on historical data. The market you are selling into today may look very different from the market used to calculate your assessment.

2. Property Specifics Are Generalized

Mass appraisal models cannot fully account for:

Renovations

Deferred maintenance

Layout differences

Views, lot orientation, or privacy

Noise or location nuances

Two homes with identical assessments can perform very differently when listed.

3. Micro-Markets Matter in Calgary

Calgary real estate is not one market. It is hundreds of micro-markets.

For example:

NW Calgary vs SE Calgary

Inner-city condos vs suburban townhomes

Homes near transit vs car-dependent locations

New builds vs mature neighbourhood properties

Assessments average these differences. Buyers do not.

Why Online Home Value Tools Fall Short

Many homeowners turn to online valuation tools or real estate apps to estimate value. While these tools are helpful for browsing, they have similar limitations to city assessments.

They typically cannot account for:

Recent off-market sales

Condition and upgrades

Buyer psychology

Listing strategy and presentation

Local competition at the time of sale

Online estimates are best viewed as starting points, not decision-making tools.

When Your Calgary Assessed Value Can Still Be Useful

While assessed value should not be used to price a home, it can still provide insight when used correctly.

It can help with:

Understanding long-term neighbourhood trends

Identifying areas of strong historical demand

Supporting an appeal if the assessment is clearly out of line

Comparing your home to similar properties citywide

The key is context.

Should You Appeal Your Calgary Property Assessment?

In some cases, yes. In many cases, no.

An appeal may make sense if:

Your assessment is significantly higher than similar nearby properties

Key property details are incorrect

Comparable sales used by the City do not reflect your home’s condition or location

An appeal is not recommended simply because your assessment went up.

Appeals require evidence, time, and a clear understanding of both assessed value and market value.

The Difference Between Assessment, Market Value, and Sale Price

These three terms are often used interchangeably, but they are not the same.

Assessed value is a tax tool based on past data

Market value is an estimate based on current conditions

Sale price is what a buyer actually pays

A strong marketing strategy, good timing, and proper pricing can push a sale price above both assessment and market value. Poor strategy can result in the opposite.

How Home Collective Determines Real Market Value

At Home Collective, market value is not treated as a single number.

It is a range informed by:

Live comparable sales and active listings

Buyer behaviour in your specific neighbourhood

Property-type performance trends

Condition and presentation

Timing and market momentum

This approach allows homeowners to make informed decisions, whether they are selling now, selling later, or simply planning ahead.

Why Understanding Your True Home Value Matters

Knowing your real market value helps you:

Decide whether selling makes sense

Plan your next purchase with confidence

Avoid overpricing or underpricing

Understand refinancing or equity options

Prepare for future life transitions

For many homeowners, value is not just about money. It is about timing, lifestyle, and peace of mind.

Clarity Beats Guesswork

City assessments serve an important purpose, but they are not a pricing strategy.

If you are wondering what your Calgary home is worth today, the most valuable step is not checking another app or comparing last year’s numbers.

It is having a clear, local, and honest conversation about your home and the current market.

If you would like a personalized look at how your home fits today’s Calgary real estate market, Errol Biebrick and the Home Collective team are always happy to help.